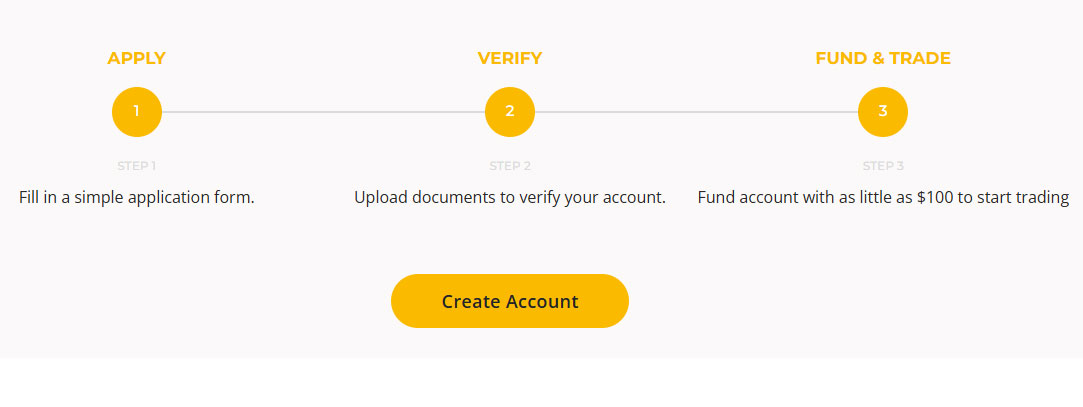

Open a trading account in less than three minutes today.

Use the intuitive platforms to buy and sell.

Receive expert support when trading commodities CFDs.

Trade the two most popular oil contracts and precious metals with competitive spreads.

Take advantage of market volatility on the commodity market.

Trade with a trusted and regulated broker.

Hassla Capital traders can access the four most traded commodities via the platform.

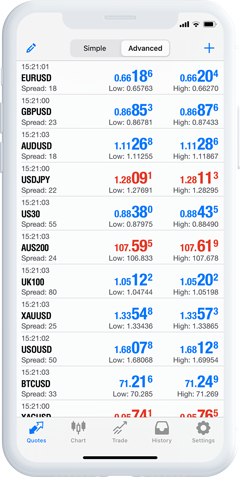

Live Commodities Prices

Live Commodities Prices

Commodities Products

Commodities are represented on exchanges that specialize in trading different raw materials and contracts based on them (CFDs, futures, options etc.), such as the London Metal Exchange (for non-precious metals), the Chicago Mercantile Exchange (for energy and metals) or the Tokyo Commodity Exchange (metals, oil, agricultural products). With Hassla Capital you can trade on the commodity exchanges using CFDs that provide greater liquidity and leveraged trading.